Aging reports provide a clear picture of outstanding accounts receivable and payable, allowing businesses to monitor their cash flow effectively. Aging reports play a pivotal role in providing businesses with comprehensive insights into their cash flow problems and the status of their outstanding invoices and bills. You might also want to calculate a business analysis ratio called the “average collection period.” This calculation shows the number of days, on average, that it takes to collect on your business sales. You can see whether this ratio goes up over time, taking a long time to collect. The percentage of net sales method aims to determine the amount of uncollectible accounts expense, while the aging method focuses on calculating the balance in the account Allowance for Uncollectible Accounts.

QuickBooks Support

The AR aging report helps analysts understand the average age of their customers’ outstanding invoices and collect the dues within a stipulated period. In this article, we will comprehensively cover everything about accounts receivable aging reports. We will explain their purpose, why they are crucial, and how to create them. As you go through the report, you may notice one or two clients responsible for most of your late payments and proceed with the necessary measures. However, if you note multiple clients with repeated late payments, it indicates a credit policy issue.

Accounts Payable

With accounting software like QuickBooks Online, you can generate an A/R aging report in just minutes. Within QuickBooks, click Reports in the left-hand menu bar and look for the Accounts Receivable Aging Report. You can also aging of accounts receivable create one manually using Excel or Word by listing your outstanding invoices by due date, but it can be very time-consuming. You should generate an accounts receivable aging report at least once a month, if not more often.

Withhold services before payment:

Running an accounts receivable aging report helps your staff analyze customers’ late payment behaviors and determine which customers they need to prioritize contacting regarding unpaid invoices. The decision to prioritize outreach initiatives—typically based on dollar amounts or number of days overdue—is made easier with AR aging reports as the data needed is at your fingertips. As a small business owner, there’s nothing more disgruntling than not getting paid. Business owners use accounts receivable aging reports to determine which customers have invoices with outstanding balances. This collection tool makes it easy for businesses to identify late-paying customers and set invoice payment terms. An accounts receivable aging report is essential for maintaining a healthy cash flow and preventing collection issues from becoming major problems.

Take the headache out of growing your software business

The purpose of this accounts receivable aging is to show you what receivables must be dealt with more urgently because they’ve been overdue longer. This report is standard with most business accounting software programs, including online systems. The aging method is used because it helps managers analyze individual accounts. This provides information which can be used to determine whether any further collection efforts are justified or not.

- Once a method of estimating bad debts is chosen, it should be followed consistently.

- This way, you can stay on top of customer payments and take action when needed.

- To prepare it, you break down the accounts receivables into age categories and indicate against the names the total outstanding balances for specified periods.

- Most retail businesses do not carry receivables because they tend to sell product for cash on delivery.

You can — and should — determine your accounts receivable days to pay for your entire company on a regular basis. Doing so will help you determine when customers are starting to pay more slowly, which will, in turn, help you prevent cash flow problems in your business. If you extend credit to your customers, managing your accounts receivable is one of the most important accounting functions in your business. Without proper management, your accounts receivable can get out of control, causing significant cash flow problems for your business.

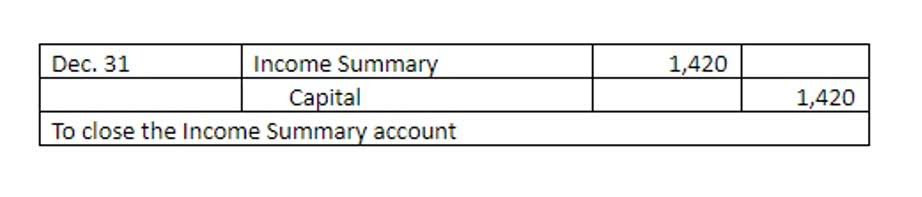

Aging Method of Accounts Receivable/Uncollectible Accounts

- It provides a breakdown of the company’s accounts receivable based on the length of time the invoices have been outstanding, typically in categories such as current, 30 days, 60 days, and 90+ days.

- Without an accounts receivable aging report, it can be difficult to maintain a healthy cash flow and identify potentially bad credit risks to your business posed by doubtful accounts.

- This means that the report will show the previous month’s invoices as past the due date, when, in fact, some could have been paid shortly after the aging report was generated.

- Since overdue accounts hold up cash flow, the AR aging report can be used to make sure your outstanding payments don’t create an issue with suppliers.

- This amount can be calculated across all your customers, but you can also calculate it for individual customers.

- Billie Anne is a freelance writer who has also been a bookkeeper since before the turn of the century.