Appreciate pension in the home you adore. With an opposite mortgage, you do not need to offer your home to help you free up their guarantee. You could generally get cake and you will consume it also, staying in the home you know and you may love and wearing availability for the residence’s collateral at the same time.

Competitive introductory interest rate. During the Portal we offer an aggressive introductory interest rate towards very first five years of opposite home loan. This minimises this new perception off compounding interest and you may makes even more equity in your home. Attract earned on the currency you have lent could well be included into their unique amount borrowed, meaning it is possible to only need to pay they at the conclusion of your contrary mortgage package.

Personal line of credit. It indicates it is possible to pay just focus for the finance that you have fun with, it is therefore an easily affordable and prominent earnings injection.

Flexible drawdowns and costs. You could make repayments and you may 800 loan bad credit direct lender drawdowns on your contrary home loan whenever you need to, providing you higher control of your money. You could make as much volunteer payments as you wish so you can reduce the degree of attention reduced, nevertheless aren’t needed to spend something before the avoid of the bargain.

Effortless access to your bank account. Availability your reverse mortgage funds using the same easier actions while the your own almost every other Gateway membership. You can access your bank account thanks to on the internet financial, mobile financial and you can during your Charge Eco Debit Credit.

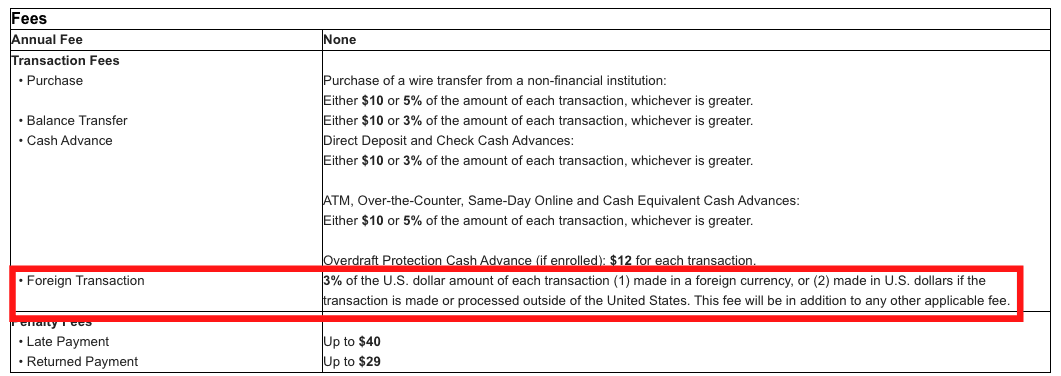

Zero invisible costs. Their reverse home loan tend to bear zero annual costs and no lingering loan administration charge, very a lot more of your money stays in your bank account.

Supply as much as $1 million. Access borrowing all the way to a maximum of $step 1,100000,00. The minimum opposite financial count is actually $50,000.

- No Negative Equity Guarantee. A contrary mortgage having Portal is sold with the latest Zero Negative Guarantee Be certain that hence ensures you will never owe much more about your loan than what your house otherwise property is well worth. In case your possessions sells for lower than the fresh outstanding amount borrowed, we’ll protection the difference.

Please note that each personal is different and you may a reverse home loan is almost certainly not the best choice for your requirements. Read about the opposite home loan selection below otherwise correspond with an effective economic advisor.

Household Collateral Loan compared to Reverse Financial

Home guarantee money and reverse mortgage loans create similar properties, leverage current collateral in property so you’re able to free up cash getting a homeowner. Here, i glance at the parallels and you will differences between both mortgage versions, who will access him or her and just how they could assist residents would the cash.

Is actually house equity finance and contrary mortgages exactly the same thing?

No, if you find yourself household equity fund and you can reverse mortgages one another leverage mortgage security since a form of mortgage and you can show specific equivalent provides they are certainly not the same thing. Property equity mortgage are reduced as the a lump sum payment and you will can be obtained to your home owners that no less than 20% equity inside their home loan. Meanwhile, an opposite financial can be found simply to retired people along side decades off sixty and that’s reduced given that a credit line, as opposed to a lump sum payment.

Require access to their home’s guarantee but aged below 60? Discover more about the EquitiSmart Line of credit household guarantee loan.

What is the Zero Negative Guarantee Guarantee?

Legally, loan providers which give opposite mortgage loans have to ensure that when your contrary home loan deal concludes you would not be expected to pay back over the worth of the home. Very, in the event the unconditionally your house costs less than the fresh amount borrowed for the Reverse Financial, you will simply need to pay the quantity that is obtained away from this new sale of your property. Your own lender is required to pay for people shortfall in case the purchases of your house will not fulfil the expense of your Opposite Mortgage. This might be known as No Bad Guarantee Make certain.